You’ve probably heard the term “stakeholder analysis.” It’s a tool that is traditionally used for project management, often with an internally focused perspective. But the concept is also relevant for strategic planning work, factoring in external stakeholders as well.

So… What is a stakeholder?

A number of years ago, companies began to realize that they needed to think beyond just their shareholders (nonprofits, which have no shareholders, have always looked at the world this way). And so, the concept of “stakeholders” — any person, group, or institution that has a stake in the outcome of an organization’s work and/or that can influence what it can or cannot do — came into popular use.

Some of these groups are obvious: customers, clients, employees, shareholders, and Board members and major donors in the case of nonprofits. Others, less so, requiring an expansive view of the landscape to ensure that every important stakeholder is considered.

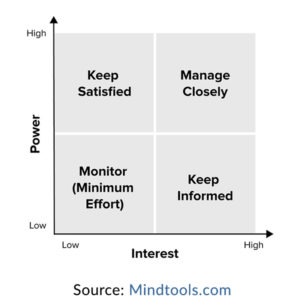

The 2×2 Matrix

One common way of identifying and thinking about stakeholders is to map them in a classic 2×2 matrix (see diagram). Along one axis is the level of interest the stakeholder group is likely to have in the actions or plans you want to undertake. Along the other is the degree of power or influence they might have over your actions.

The further out on these axes a given stakeholder is situated, the more you’ll want to concern yourself with their point of view.

For example, consider the case of a local performing arts organization that hopes one day to have its own performance venue. Naturally, its employees and affiliated performers are important stakeholders in this issue, as are its Board and donors who will be largely responsible for helping to fund such a project.

But there are other stakeholders that also need to be considered. Other performing arts organizations, for example, may be interested in making use of the new facility. Conversely, they might view this plan as being in conflict with their own venue. Similarly, the city’s real estate development agency will undoubtedly have a point of view and influence; understanding what is important to them matters as well.

The point is, thinking carefully about who the potential stakeholders are, what they care about, and how much influence they can have, helps you to consider a broad range of approaches to your plan. Positioning within the 2×2 matrix can be very helpful in this regard:

- High interest, high power. Work closely with this group. Be sure you understand what is important to them and how your work can best align with their interests. If that is difficult to accomplish, at least be prepared to consider ways to bring your interests and theirs into closer alignment.

- Low interest, high power. While this group may not care very much about your plans, their ability to sidetrack them or influence the opinion of others can be substantial. If you can increase their interest in a positive way, you may even benefit from their power.

- High interest, low power. You may be tempted to ignore this group given their modest amount of power. However, while these individuals may not possess a great deal of influence, keeping them in the loop regarding your plans may increase their influence collectively.

- Low interest, low power. This group should be monitored, but not ignored. Should circumstances change, as they often do, the group’s position on the matrix can change as well – a change that may be unfavorable to you if they have been shut out entirely.

Verify Your Assumptions

Stakeholder identification can be especially challenging when exploring a sector that you don’t know all that well. In those cases, it’s particularly important to do some research.

Generally, I begin with secondary research — often starting with Google, but also seeking out more specialized resources, such as relevant trade journals or specialty data sources if they exist. You won’t find all the answers you need in this way, but you can get yourself a basic education into topics of importance before getting out and talking to people (primary research). The more you know before conducting live interviews, the better your questions will be and the quicker you will come up to speed as you speak with others.

Secondary research also can help identify the right people to reach out to for your primary research. I often begin by seeking out industry analysts or reporters, since they have a broader perspective. From there, I get more targeted.

And by the way, don’t forget to tap your “warm contacts” — friends, colleagues, or connections through your business network, LinkedIn, etc. All of these people — and the people they know — can help you in your quest for information.

Reflections

The more you know, understand, and consider the various players and organizations that may be impacted by your future plans and actions, the less likely you are to run into roadblocks along the way.

By carefully and thoroughly considering all stakeholders, you will greatly improve your chances of success!